s-f.site

Community

How To Open A Zelle Account Chase

If you only have a savings account you will not have access to Zelle. Additionally Chase First Banking accounts don't support Zelle or any peer-. To Enroll, accept terms and conditions, tell us your email address or U.S. mobile number and deposit account, and then you will receive a one-time verification. Enrollment in Zelle® with a U.S. checking or savings account is required to use the service. Chase customers must use an eligible Chase consumer or business. Open your Wells Fargo, Bank of America, Chase, Citi, or PNC app. Find and open the Zelle® section within the app. Unlink your phone number from Zelle®. Open the. How to access Zelle® from Citizens Mobile Banking · Make sure you have the updated app · Open and login to Citizens Mobile Banking app · Select 'Send Money with. Open the Bank of America® Mobile Banking app. Sign in and tap "Pay & Transfer," then Zelle® and follow the on-screen instructions. Sign in to the Chase Mobile® app and tap "Pay and Transfer" · Tap "Send Money with Zelle®" · Tap "Get started" (you may need to agree to terms and conditions). It's never too early to begin saving. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Credit. Enroll in Zelle® · Sign in to s-f.site · Select “Pay & transfer” · Select “Pay bills & send money with Zelle®” · Select "Get started" (you may need to. If you only have a savings account you will not have access to Zelle. Additionally Chase First Banking accounts don't support Zelle or any peer-. To Enroll, accept terms and conditions, tell us your email address or U.S. mobile number and deposit account, and then you will receive a one-time verification. Enrollment in Zelle® with a U.S. checking or savings account is required to use the service. Chase customers must use an eligible Chase consumer or business. Open your Wells Fargo, Bank of America, Chase, Citi, or PNC app. Find and open the Zelle® section within the app. Unlink your phone number from Zelle®. Open the. How to access Zelle® from Citizens Mobile Banking · Make sure you have the updated app · Open and login to Citizens Mobile Banking app · Select 'Send Money with. Open the Bank of America® Mobile Banking app. Sign in and tap "Pay & Transfer," then Zelle® and follow the on-screen instructions. Sign in to the Chase Mobile® app and tap "Pay and Transfer" · Tap "Send Money with Zelle®" · Tap "Get started" (you may need to agree to terms and conditions). It's never too early to begin saving. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Credit. Enroll in Zelle® · Sign in to s-f.site · Select “Pay & transfer” · Select “Pay bills & send money with Zelle®” · Select "Get started" (you may need to.

Enrollment in Zelle® with a U.S. checking or savings account is required to use the service. Chase customers must use an eligible Chase consumer or business. To set up Zelle, all you need is a bank account. You can access the service either through your financial institution's mobile app or website or through Zelle. The money will move directly into your bank account associated with your profile, typically within minutes1. We're open. Mon-Sun 10 a.m. to 10 p.m. (ET). Open your KeyBank mobile app or sign on to online banking, select Send Money with Zelle®, and register · Select your recipient · Enter the payment amount · You can. It's easy – just start using Zelle® in your Chase Mobile® app or on s-f.site! Simply login and choose “Send money with Zelle® ” in the side menu to get started. Zelle® has partnered with leading banks and credit unions across the U.S. to bring you a fast, safe and easy way to send money to friends and family. The best part? You don't need a personal account number. To complete a Zelle® money transfer, just sign in to the Navy Federal mobile app* or online banking. 1) Log into your Chase bank account · 2) Select Send Money from Zelle on your Chase bank account · 3) Complete your recipient's information · 4). View our Deposit Accounts FAQ for more information, including how to access your accounts on JPMorgan Chase online and mobile banking. Zelle®, wires or other. Discuss your financial needs on a day and at a time that work best for you. Open an account. Explore credit cards, savings or checking accounts, home loans. Chase customers must use an eligible Chase consumer or business checking account, which may have its own account fees. Consult your account agreement. To send. Open a savings account or open a Certificate of Deposit (see interest rates) Zelle. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo. It's never too early to begin saving. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Credit. Open the Zelle app on your phone and log in to your account. From the main menu, select the "Send" option. Enter your friend's phone number in the "To" field. You can use the Chase mobile app or website to move money from another bank account, or you can have someone send you funds through Zelle. You can also fund. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. Devices such as Chromebooks, Laptops, Tablets or iPads are not supported to download or use the Zelle® app. You must have a bank account in the U.S. (not. Enrollment in Zelle® is required. Eligible U.S. bank account required. Terms and conditions apply. Learn more at s-f.site Zelle and the Zelle related. Will I continue to have access to my Move Money activity history on First Republic online banking, including historical transfers, Zelle activity. I'm incredibly financially stable with more money in my Chase checking account than I should even have and they pull this shit with me, too. It.

How To Trade Stocks On Your Own

When trading short stock, you don't own the stock—you borrow the shares and sell it on the open market with the intention of buying it back at a lower price to. There, you can enter the stock symbol (aka ticker) and quantity of shares before previewing your trade tickets and submitting your order. your own research. Stocks by the Slice SM makes dollar-based investing easy. Own a slice of your favorite companies and exchange-traded funds (ETFs) for as little as $ Get. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. Purchasing stocks will generally require a stockbroker. The most common type of stock brokerage is an online/discount broker. Trading stocks at Vanguard means no account minimums and $0 commissions. See how individual stocks and ETFs can complement your portfolio. Want to buy and sell stocks online? If you're interested in investing on your own, you'll first need a direct investing account with an online brokerage. However, you can take part in self-directed trading by using a broker-dealer platform. Stock trading without the typical broker can help you avoid hefty. When trading short stock, you don't own the stock—you borrow the shares and sell it on the open market with the intention of buying it back at a lower price to. There, you can enter the stock symbol (aka ticker) and quantity of shares before previewing your trade tickets and submitting your order. your own research. Stocks by the Slice SM makes dollar-based investing easy. Own a slice of your favorite companies and exchange-traded funds (ETFs) for as little as $ Get. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. Purchasing stocks will generally require a stockbroker. The most common type of stock brokerage is an online/discount broker. Trading stocks at Vanguard means no account minimums and $0 commissions. See how individual stocks and ETFs can complement your portfolio. Want to buy and sell stocks online? If you're interested in investing on your own, you'll first need a direct investing account with an online brokerage. However, you can take part in self-directed trading by using a broker-dealer platform. Stock trading without the typical broker can help you avoid hefty.

The most common way to buy and sell shares is by using an online broking service or a full service broker. Low-cost index funds that track the overall market are often the best choice for investors without the time or inclination to do their own research, Burke says. Brokers get compensated through commissions, although many now offer commission-free trading for trading stocks. Brokers offering free stock trading include TD. Create Your Own Custom Stock Market Game · Set your own dates · Choose your cash balance · Customize trading rules · Add reading assignments. 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares, then enter an amount. Investing and trading online is an easy, low-cost way to start putting your money to work. With a do-it-yourself investing approach, you can easily buy and sell. Preparing for a Stock Trading Business Plan. You first must educate yourself about the stock market and stock trading. · Types of Trading Businesses. Next. For instance, investors can use an online brokerage account to trade stocks on their own, or invest using different types of investment plans. But there can. Consider getting a broker. The easiest way to trade stocks will be to pay someone else to trade stocks. There are a number of well known stock brokers, and you. This means the value of your investments can fall as well as rise, so you might get back less than you originally invested. Remember that everyone has their own. How to Invest in Stocks Without broker · Find a DP on the website of CDSL or NSDL. · Once you have found a DP, contact them and request to open a Demat Account. Diversification and asset allocation strategies do not ensure profit or protect against loss in declining markets. Investors should assess their own investment. As the name implies, common stock is probably the type of stock you're most likely to buy or own. How to buy stocks. You can buy or sell stocks by. We are Sarwa · Understand how the stock market works · Create a trading plan · Practice and improve your trading plan · Select a trading platform · Open an account. Buy direct. Some companies offer direct stock purchase plans (DSPPs). Search online or call or write the company whose stock you wish to buy, to inquire whether. A SEP-IRA if you're self-employed or own a small company. Settlement fund You'll pay no commission to trade ETFs & stocks online in your Vanguard Brokerage. You can buy and sell stocks through: Direct stock plans. Some companies allow you to buy or sell their stock directly through them without using a broker. your own money on the It wouldn't make too much sense to day trade penny stocks with your retirement funds since that would be extremely high risk. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. Make unlimited $0 online stock, ETF, and option trades with a Merrill Edge Self-Directed account. Invest on your own with our exclusive insights and tools.

What Are Sri

IA Clarington Inhance SRI Funds, managed by Vancity Investment Management Ltd. (VCIM), can help grow your wealth in a way that aligns with your personal. Socially responsible investing is on the rise, but the history of SRI dates back centuries. Explore the origins of SRI to see how this movement came to be. SRI. Socially responsible investing goes one step further than ESG by eliminating or adding investments based solely on a specific ethical consideration. For. SRI (Socially Responsible Investment) funds: "SRI is an investment which aims to reconcile economic performance with social and environmental impact by funding. tackling aggressive tax planning practices (PRI). A policy for voting at general meetings based on guiding principles aligned with ERAFP's SRI approach, namely. A global leader in R&D with deep roots in Silicon Valley, SRI is an independent nonprofit research institute with a rich history of supporting government and. Opponents of SRI argue that the application of non-financial considerations, such as environmental, social, and governance. (ESG) factors, to the investment. The meaning of SRI is —used as a conventional title of respect when addressing or speaking of a distinguished Indian. Socially responsible investing (SRI) can make a difference in our lives, our society and our environment, without compromising on performance! IA Clarington Inhance SRI Funds, managed by Vancity Investment Management Ltd. (VCIM), can help grow your wealth in a way that aligns with your personal. Socially responsible investing is on the rise, but the history of SRI dates back centuries. Explore the origins of SRI to see how this movement came to be. SRI. Socially responsible investing goes one step further than ESG by eliminating or adding investments based solely on a specific ethical consideration. For. SRI (Socially Responsible Investment) funds: "SRI is an investment which aims to reconcile economic performance with social and environmental impact by funding. tackling aggressive tax planning practices (PRI). A policy for voting at general meetings based on guiding principles aligned with ERAFP's SRI approach, namely. A global leader in R&D with deep roots in Silicon Valley, SRI is an independent nonprofit research institute with a rich history of supporting government and. Opponents of SRI argue that the application of non-financial considerations, such as environmental, social, and governance. (ESG) factors, to the investment. The meaning of SRI is —used as a conventional title of respect when addressing or speaking of a distinguished Indian. Socially responsible investing (SRI) can make a difference in our lives, our society and our environment, without compromising on performance!

Impact investing refers to private funds, while SRI and ESG investing involve publicly traded assets. What is SRI Index? Definition of SRI Index: This index is a capitalization-weighted index that provides exposure to those responsible businesses that have. Environmental, Social and Governance (ESG) and Sustainable Responsible Investment (SRI). Apr 19, |. 7 min read. Featured Posts. IA Clarington Inhance SRI Funds, managed by Vancity Investment Management Ltd. (VCIM), can help grow your wealth in a way that aligns with your personal. Socially responsible investing (SRI) is for people who want to align their socially conscious values with their investment portfolios. SRI is a leading American nonprofit research institute creating some of the world's most important innovations. If you want to invest sustainability, you probably have come across three terms commonly used by fund providers: ESG, SRI, and Impact Investing. In December , following the success of McGill's previous socially responsible investing (SRI) initiatives and their completion two full years ahead of. Integrating your values with your investments is called socially responsible investing (SRI), impact investing, or ESG investing. SRI and non-SRI fund performances are nearly identical at the mean, supporting the conclusion by. SRI proponents that, on average, socially conscious investing. Socially Responsible portfolio. Our Socially Responsible Investing (SRI) portfolio maximizes returns, minimizes fees, and helps you invest without compromising. The MSCI SRI Indexes are designed to represent the performance of the companies with high ESG ratings. SRI is a leading American nonprofit research institute creating some of the world's most important innovations. A guarantee of transparency and excellence, the French government's SRI (Socially Responsible Investment) label is awarded to investment solutions that me. We are going to focus on defining the two terms most prevalent in the investment world, Socially Responsible Investing (SRI) and Environmental, Social, and. There are three core approaches in SRI. First, screening is the practice of evaluating investment portfolios or mutual funds based on social, environmental. Socially responsible investing (SRI) is the principle that investors should consider the full range of benefits and harms that a business may cause for. Increase your impact with Socially Responsible Investments (SRI) Socially responsible investment options help donors maximize their charitable impact by. Socially Responsible Investing (SRI) refers to the investment approach that integrates ethical, social, and environmental considerations into financial. ESG is often used interchangeably with Socially Responsible Investing (SRI), values-based investing, impact investing, and sustainable investing. For more.

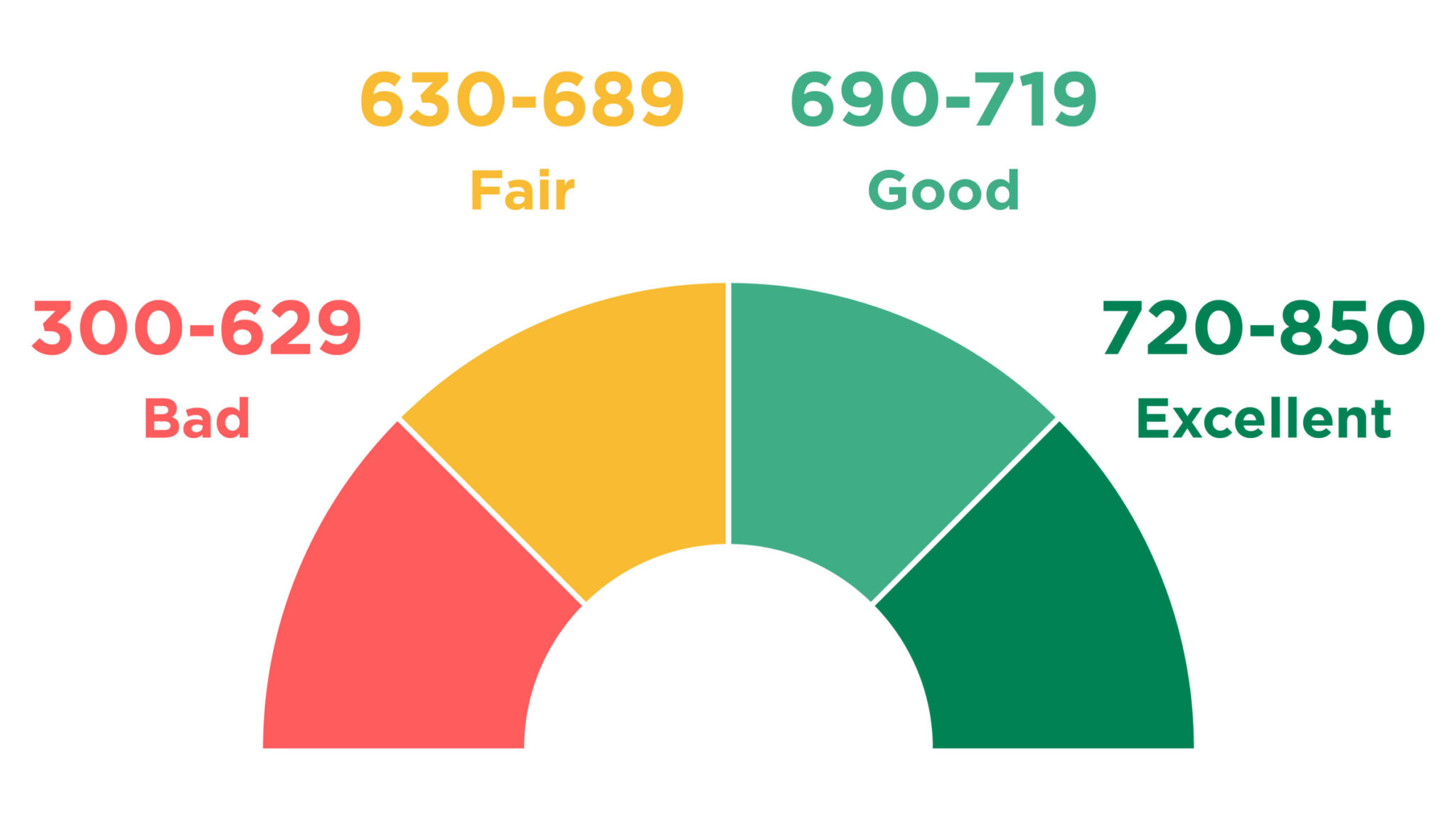

Can You Get A Mortgage With A Low Credit Score

Whether you have poor credit or no credit score at all, adding a creditworthy cosigner to your mortgage loan can be one way to improve your approval odds. A. You can buy a home with a credit score, especially if you have a steady income and relatively low monthly debts. Yes, it's possible to get a mortgage even if you have bad credit. We'll cover how to do it but, first, let's go over what's considered “bad” credit and how. If your FICO score is less than , it may be difficult for lenders to give you a home loan; but this does not mean you cannot get a mortgage. With a loan backed by the government like an FHA loan, you can qualify for a mortgage even with a credit score of It might be tempting to buy a home as. People who have bad credit often believe that there is no way they will ever get a mortgage to buy their own homes. Fortunately, this is not the case. However, government-backed mortgages like Federal Housing Administration (FHA) loans typically have lower credit requirements than conventional fixed-rate loans. Unlike traditional banks, B lenders, both institutional and private, offer more lenient approval criteria, accepting derogatory credit and low credit scores. Yes, you can still get a house with bad credit, but it may be more challenging. You may need to explore options like FHA loans or work on. Whether you have poor credit or no credit score at all, adding a creditworthy cosigner to your mortgage loan can be one way to improve your approval odds. A. You can buy a home with a credit score, especially if you have a steady income and relatively low monthly debts. Yes, it's possible to get a mortgage even if you have bad credit. We'll cover how to do it but, first, let's go over what's considered “bad” credit and how. If your FICO score is less than , it may be difficult for lenders to give you a home loan; but this does not mean you cannot get a mortgage. With a loan backed by the government like an FHA loan, you can qualify for a mortgage even with a credit score of It might be tempting to buy a home as. People who have bad credit often believe that there is no way they will ever get a mortgage to buy their own homes. Fortunately, this is not the case. However, government-backed mortgages like Federal Housing Administration (FHA) loans typically have lower credit requirements than conventional fixed-rate loans. Unlike traditional banks, B lenders, both institutional and private, offer more lenient approval criteria, accepting derogatory credit and low credit scores. Yes, you can still get a house with bad credit, but it may be more challenging. You may need to explore options like FHA loans or work on.

Having an uninsured mortgage can help lower your monthly payment and allow you to apply for a longer amortization period (the length of time you have to pay off. It's possible to get a mortgage with bad credit, although you'll probably pay higher interest rates and you may need to come up with a larger deposit. Bad credit may not keep you from getting a mortgage, but it increases the costs of buying a home. Still, there are times when you might opt to buy a home even. A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Sure. If you have a VERY LARGE down-payment, the bank can overlook bad credit to give you a loan. But it has to be A LOT. They can have rigid requirements in comparison with other loans. Most mortgage lenders will accept a minimum credit score of for a conventional loan. It. Luckily we provide mortgages for people with bad credit scores. We accept ANY credit score (even bad ones). Together we'll make it easy for you to get a bad. Yes, it's still possible to get a joint mortgage, even if one of you has bad credit. However, it'll be more difficult than if you both had perfect credit. If you want to buy a home, your options of getting a loan with bad credit can be quite limited. Most lenders will conduct a credit check on anyone applying to. Getting a mortgage with bad credit is possible, but it can be harder. Lenders will look at the credit score of people who apply for a mortgage. Key Takeaways · In Canada, bad credit mortgages are tailored for individuals with low credit scores · They are typically offered by B-lenders and private mortgage. Most lenders will issue government backed FHA loans and VA loans to borrowers with credit scores as low as Some even start at . This first option, if you don't have time to try and improve your credit score, is to go to a private lender. Your broker will arrange the mortgage in a. Yes, it's possible to secure a mortgage for bad credit. While traditional lenders may be hesitant, mortgage brokers specializing in bad credit can help you find. That could potentially give you access to better interest rates. What credit score do I need to get a mortgage? Here's a quick summary of how different credit. With a or lower credit score, you'll have to go through manual underwriting so that mortgage lenders can get into the details of your financial. But lenders can raise their own requirements. Keep in mind: For a conventional mortgage, you'll also typically need a low debt-to-income ratio, which measures. Short answer is yes, if you have a decent job and low debt. A co signer can increase your chances as well if they are employed or have collateral. Individuals with bad credit mortgages will face higher down payment requirements when obtaining a mortgage. Your financial situation may be challenging, but you.

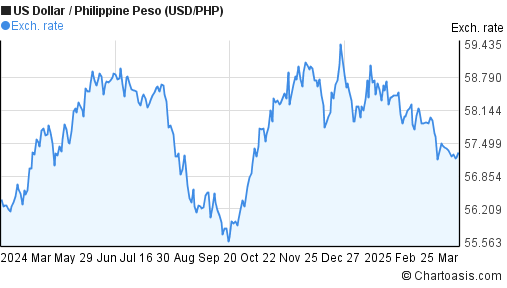

Usd To Php Rate Today

The exchange rate for US dollar to Philippine pesos is currently today, reflecting a % change since yesterday. Over the past week, the value of US. In the past 30 days, the USD to PHP exchange rate reached a high of and a low of , with an average rate of The overall change in this. Download Our Currency Converter App ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 20 USD, 1, PHP. USD to PHP | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Philippine Peso. What's the best PHP to USD exchange rate today? As of September 1, PM UTC, the best PHP to USD exchange rate is USD. This means that for. USD, $ 1, $ 5, $ 10, $ 50, $ , $ , $ PHP, , , , k, k, k, k. Currency Table PHP / USD 09/01/ Current exchange rate US DOLLAR (USD) to PHILIPPINES PESO (PHP) including currency converter, buying & selling rate and historical conversion chart. Based on the current rate, you could get PYUSD for 1 PHP. How much In other words, to buy 5 PayPal USD, it would cost you ₱ PHP. 1 USD = PHP Sep 01, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. The exchange rate for US dollar to Philippine pesos is currently today, reflecting a % change since yesterday. Over the past week, the value of US. In the past 30 days, the USD to PHP exchange rate reached a high of and a low of , with an average rate of The overall change in this. Download Our Currency Converter App ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 20 USD, 1, PHP. USD to PHP | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Philippine Peso. What's the best PHP to USD exchange rate today? As of September 1, PM UTC, the best PHP to USD exchange rate is USD. This means that for. USD, $ 1, $ 5, $ 10, $ 50, $ , $ , $ PHP, , , , k, k, k, k. Currency Table PHP / USD 09/01/ Current exchange rate US DOLLAR (USD) to PHILIPPINES PESO (PHP) including currency converter, buying & selling rate and historical conversion chart. Based on the current rate, you could get PYUSD for 1 PHP. How much In other words, to buy 5 PayPal USD, it would cost you ₱ PHP. 1 USD = PHP Sep 01, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and.

%. (1Y). 1 USD = PHP. Sep 1, ,

Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. 1 USD = PHP · Our Dollar to Philippine Peso conversion tool gives you a way to compare the latest and historic interbank exchange rates for USD to PHP. For instance, if the Philippine foreign exchange rate vs USD is at rate today will most likely be different from the rate tomorrow. For more. Find the current US Dollar Philippine Peso rate and access to our USD PHP converter, charts, historical data, news, and more. Current USD to PHP exchange rate equals Philippines Pesos per 1 Dollar. Today's range: Yesterday's rate The change for today +. Get US Dollar/Philippine Peso FX Spot Rate (PHP=:Exchange) real-time stock quotes, news, price and financial information from CNBC. US Dollar to Philippine Peso Exchange Rate is at a current level of , up from the previous market day and down from one year ago. Philippine Peso Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Indian Rupee. Actual USD to PHP exchange rate equal to Philippines Pesos per 1 Dollar. Today's range: Previous day's close Change for today. Remitly offers dependable exchange rates for USD to PHP with no hidden fees. Join today and get a promotional rate of PHP to 1 USD on your first money. US Dollars to Philippine Pesos conversion rates ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 25 USD, 1, PHP. US Dollars to Philippine Pesos conversion rates ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 25 PHP, USD. Convert Philippine Peso to US Dollar ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 25 PHP, USD. Listed below are today's best exchange rates for US Dollar to Philippine Pesos, in real time, from various money transfer companies. USD to PHP historical rates ; Average, ; September 30, , ; October 31, , ; November 30, , Currency Converter · Exchange Rate History For Converting Dollars (USD) to Philippine Pesos (PHP) · Currency Charts · Exchange Rate Today For Converting Dollars to. Live USD/PHP Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; Today's High: ; Today's Low: ; Previous day's Close: Philippine Peso per US Dollar Exchange Rates: Daily Peso per US Dollar · Daily Daily (current day) · Daily (starting January ). Cross Rates: Daily. Daily Philippine Peso per US Dollar Rate ; 2, ; 3, ; 4, ,

Investing Money On Stocks

Here's a step-by-step guide to investing money in the stock market to help ensure you're doing it the right way. The best way to invest in stocks Index funds. They are the best way to make money in stocks. Index funds put their money in indexes like the S&P or the. Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.”. Here's a quick guide to get you started. The first step is outlining your goal(s) for the money you're investing. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation. Active investing relies on real-. All investments involve some degree of risk. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand. Where to Start Investing in Stocks. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Here's a step-by-step guide to investing money in the stock market to help ensure you're doing it the right way. The best way to invest in stocks Index funds. They are the best way to make money in stocks. Index funds put their money in indexes like the S&P or the. Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.”. Here's a quick guide to get you started. The first step is outlining your goal(s) for the money you're investing. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation. Active investing relies on real-. All investments involve some degree of risk. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand. Where to Start Investing in Stocks. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more.

When it comes to investing in the stock market, there's no such thing as the perfect approach. Each investor is unique and has their own investment style based. What is a stock? · Mutual fund. A type of investment that pools shareholder money and invests it in a variety of securities. Each investor owns shares of the. Learn how to invest in stocks with this comprehensive beginner's guide. Discover the essential steps, tips, and strategies to start growing your wealth. Stock funds are offered by investment companies and can be purchased directly from them or through a broker or adviser. Researching Stocks. Before investing in. William J. O'Neil's national bestseller How to Make Money in Stocks has shown over 2 million investors the secrets to successful investing. William J. O'Neil's national bestseller How to Make Money in Stocks has shown over 2 million investors the secrets to successful investing. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. Investing in stocks can create a portfolio, creating and building your wealth. Learn how to trade stocks and the benefits of stock investments with J.P. One way investments generate income is through dividends. If you have invested in a company by buying shares, for example, that company may pay you a small. I'm incredibly new to investing and was curious what's the best way to learn how to research companies and how to learn how to build a long term portfolio. An investment calculator can help you figure out how to meet your goals. It can show you how your initial investment, frequency of contributions and risk. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. While everyone's financial situation is different, there are a few telltale signs that someone is not ready to start investing. People aim to make money from investing in shares through one, or both, of the following ways: An increase in share price. Usually known as 'capital growth' or. The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest. Investing in stock offers no guarantee that you will make money, and many investors lose money instead. Payment of stock dividends is not guaranteed, and. Investors tend to divide funds among stocks, bonds, and cash equivalent investments based on risk tolerance and timeline. Dividing further, investors often. A first step is thinking through your investment goals, time horizon, and ability to handle risk. This is key, as any investment involves some risk of losing. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments. When you purchase shares you're buying a stake in a company. Shares are traded throughout the day on the stock exchange and the price can go up and down. Pros.

How To Invest In Single Family Homes

Single-family homes have emerged as a popular type of rental property due to an evolving rental market and a growing local economy. Read about four of the top reasons commercial real estate investors should invest in multifamily real estate as opposed to investing in single family. Single family rental homes are an excellent investment for people who want to manage the property themselves without having to worry about hiring someone else. Read about four of the top reasons commercial real estate investors should invest in multifamily real estate as opposed to investing in single family. Roofstock provides investors with data, services and solutions to help acquire, manage and dispose of single family rentals (SFR). 8 places to find single-family investment properties · 1. Crowdfunding platform Roofstock · 2. Multiple listing service (MLS) · 3. Privy · 4. Zillow · 5. Things to Note When Investing in Single-Family Homes · Carefully choose the location of the single-family home. · Conduct thorough market research to understand. I like multi unit. The cost per unit is always less than single family. If you lose a tenant you are not % vacant. You control more rental. You can get extreme (and extremely cheap) leverage with homes due to mortgages. This leverage increases your returns massively. You can get rent. Single-family homes have emerged as a popular type of rental property due to an evolving rental market and a growing local economy. Read about four of the top reasons commercial real estate investors should invest in multifamily real estate as opposed to investing in single family. Single family rental homes are an excellent investment for people who want to manage the property themselves without having to worry about hiring someone else. Read about four of the top reasons commercial real estate investors should invest in multifamily real estate as opposed to investing in single family. Roofstock provides investors with data, services and solutions to help acquire, manage and dispose of single family rentals (SFR). 8 places to find single-family investment properties · 1. Crowdfunding platform Roofstock · 2. Multiple listing service (MLS) · 3. Privy · 4. Zillow · 5. Things to Note When Investing in Single-Family Homes · Carefully choose the location of the single-family home. · Conduct thorough market research to understand. I like multi unit. The cost per unit is always less than single family. If you lose a tenant you are not % vacant. You control more rental. You can get extreme (and extremely cheap) leverage with homes due to mortgages. This leverage increases your returns massively. You can get rent.

Starting out, most of the real estate investing basics that I was exposed to around single family home investing was this: "You, the investor, pays for the. This presents an opportunity for investors with capital to place by purchasing or investing in single family homes that can be owned and rented out to an. Positive Aspects of Single-Family Homes as Compared to Condos · Appreciation potential. · No condo fees. · Ability to set a rental amount that leaves out ongoing. Start by determining your investing criteria. For example, do you want a low-risk investment, low vacancy rates, or high returns? Determine your overarching. Pros and Cons of Investing in Single Family Real Estate · Lower acquisition cost · Faster appreciation · Potential for high returns · Less tenant turnover. SFR stands for single family residential home, one of the foundational assets in a portfolio for real estate investors looking to earn stable returns. This article looks at two of the most popular ways to invest in real estate - single-family residential and multifamily. Which is right for you? Roofstock is a data, analytics, and investment platform focused on the single-family rental sector (SFR). Our real estate investing as a. Single-family homes tend to attract longer-term renters. Families or couples are sometimes thought of as better tenants than single people because there is a. When you buy multi-family home rental properties, you may find the property appreciates more slowly compared to rental homes. But overall, if rents increase. Investing in single-family homes is a great way to secure your financial future. It is a stable investment that has the potential to make you a lot of money. Why is Wall Street buying houses? Wall Street is buying more single-family rental homes because demand for houses is high, renters' preferences are shifting. We want to make perfectly clear: BlackRock is not buying individual houses in the U.S. A number of other large asset managers and private equity firms are. The Benefits of Investing in Single-Family Home Development · The rare opportunity to own a share of a new build. · Access to high-value deals for a low minimum. Be clear about your investment timeline. Buy and hold in order to realize gains over a period of time. Despite what you hear, real estate is generally not a. Roofstock is a data, analytics, and investment platform focused on the single-family rental sector (SFR). Our real estate investing as a. Real estate investors who want to quickly build a robust investment portfolio tend to focus on multi-family construction over multiple single-family homes. Positive Aspects of Single-Family Homes as Compared to Condos · Appreciation potential. · No condo fees. · Ability to set a rental amount that leaves out ongoing. Many reasons exist why single-family homes provide a good investment for smaller investors, including easier financing, higher rates of return, better. Acquiring a single-family rental property is an attractive way to diversify one's real estate portfolio. With any type of real estate property, you also have.

Stocks That Will Go Up This Year

US stocks that increased the most in price ; JVA · D · +%, USD ; LICY · D · +%, USD ; GNLN · D · +%, USD ; LUCY · D · +%, USD. From stocks and bonds to the latest data from the government and everything in between, you'll find the team's expansive range of investing and economic. Commscope (COMM) surpassed the 4 price level for the first time since early August of Shares rocketed 31% for the week. And Bioventus (BVS), up 17% for. Among all of our plus stock selections, the average return beats the S&P But investors should note that before purchasing any stocks, it's important to. An ISA is a tax-efficient way to save or invest up to £20, a year to buy shares if you'd prefer to go down the DIY route. Plus, find out how a. A cut this week would be a pivotal move, as many investors hope the decision could lower borrowing costs for companies and improve overall earnings growth —. U.S. equities were mixed around midday as investors focused on what will happen on Wednesday, when the Federal Reserve is expected to begin cutting interest. US equity markets followed up the worst week of the year with the best week. The S&P closed higher for five consecutive sessions as the post-jobs. Growth investing, however, involves more than picking stocks that are going up. Often, a growth company has developed an innovative product or service that. US stocks that increased the most in price ; JVA · D · +%, USD ; LICY · D · +%, USD ; GNLN · D · +%, USD ; LUCY · D · +%, USD. From stocks and bonds to the latest data from the government and everything in between, you'll find the team's expansive range of investing and economic. Commscope (COMM) surpassed the 4 price level for the first time since early August of Shares rocketed 31% for the week. And Bioventus (BVS), up 17% for. Among all of our plus stock selections, the average return beats the S&P But investors should note that before purchasing any stocks, it's important to. An ISA is a tax-efficient way to save or invest up to £20, a year to buy shares if you'd prefer to go down the DIY route. Plus, find out how a. A cut this week would be a pivotal move, as many investors hope the decision could lower borrowing costs for companies and improve overall earnings growth —. U.S. equities were mixed around midday as investors focused on what will happen on Wednesday, when the Federal Reserve is expected to begin cutting interest. US equity markets followed up the worst week of the year with the best week. The S&P closed higher for five consecutive sessions as the post-jobs. Growth investing, however, involves more than picking stocks that are going up. Often, a growth company has developed an innovative product or service that.

“Our view is that in three years, India could move from primary deficit to balance,” says Desai. Sign up to get Morgan Stanley Ideas delivered to your inbox. Up-to-date stock market data coverage from CNN. Get the latest updates on US to be just under 4% next year · Former US President and Republican. Growth stocks for next 5 years ; 7. Grauer & Weil, , , ; 8. Arihant Capital, , , Wall Street Thinks Nvidia Stock Can Rise 30% in a Year. Time to Buy? The 3 Buy-Rated Cannabis Stocks Under $10 to Scoop Up Now. 20 minutes ago. Updated for ! Here's a list of top stocks to buy, along with a framework for how to identify some of the best stocks around. year, but it still has catching up to do. For the year to date through mid-July, the S&P was up 17% on a price basis. The energy sector of the S&P While expectations for a bp cut appear to be rising recently, I'll point out that over the past eight years the Fed has never made a policy move (either a. Stocks could hit a record this week, but the move may be short lived. 3 hours CNBC Newsletters. Sign up for free newsletters and get more CNBC delivered to. More importantly, it says nothing at all about whether that stock will go up or down. Midcap stocks might offer a balance of stability and growth. Holding till I die since I'm fairly certain these companies will still be around 50 years from now! will go to $27 from its current $ Best stocks to buy ; Cadence Design Systems, CDNS ; Coca-Cola, KO ; Diamondback Energy, FANG ; Thermo Fisher Scientific, TMO. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Ideally, your stock will go up in value while you own it, allowing you to sell it for more than you paid. Some companies pay out dividends. A dividend is a. The market performance data used in this study go all the way back to How do they stack up to comparable periods for other years? Figure 2 shows. Hot Stocks ; Why Nvidia's Post-Earnings Dip Is Actually Good News for Stocks · Luke Lango · Aug 29, ; Why 90% of Companies Are Investing Millions in This · Luke. Schwab's outlook is that A-rated stocks, on average, will strongly up against other stocks within the same sector and market cap group. Schwab. How do I find growth stocks that have been gradaully been going up for the last 20 years? I want to find these types of stocks that are down. Public companies are required to report their earnings four times a year (once each quarter). Some believe that it isn't possible to predict how stocks will. growth years, because these companies often pay steady dividends. Value stocks tend to have low P/E ratios and pay above-average dividends, but they might.

Pay In Installments No Credit Check

pay in easy, interest-free installments over six weeks.¹ Ef No long forms to fill out or hard credit check at signup.² You'll know if. No, Lowe's Pay can't be combined with any other payment type. Will I get a Does a Lowe's Pay loan require a credit check? Acceptance of loan offers. Sezzle It: Pay it in 4 with No Interest!¹ Tap into a new way to get what you want with Sezzle Buy Now, Pay Later. The flexibility of a credit card without the. You need to get a secured credit card. You would be able to use that card any place. It would help you build/repair your credit. You could start. All you need to do is select your travel destination, we will buy your tickets or vacation package, after which you can pay us in installments. With the book. Installment Loan Providers with No Credit Check to Prequalify · 1. Avant · 2. Upstart · 3. s-f.site · 4. s-f.site · 5. s-f.site No credit check. We make it simple! What do I need to pay in installments? You need a valid credit or debit card to complete your. No credit checks needed. Low interest and no fees. Enjoy low interest rates2 You will still owe us payment of any further minimum monthly installment payment. Your first payment may be due when the merchant payment is requested. Minimum purchase may be required. Actual terms are based on your credit score and other. pay in easy, interest-free installments over six weeks.¹ Ef No long forms to fill out or hard credit check at signup.² You'll know if. No, Lowe's Pay can't be combined with any other payment type. Will I get a Does a Lowe's Pay loan require a credit check? Acceptance of loan offers. Sezzle It: Pay it in 4 with No Interest!¹ Tap into a new way to get what you want with Sezzle Buy Now, Pay Later. The flexibility of a credit card without the. You need to get a secured credit card. You would be able to use that card any place. It would help you build/repair your credit. You could start. All you need to do is select your travel destination, we will buy your tickets or vacation package, after which you can pay us in installments. With the book. Installment Loan Providers with No Credit Check to Prequalify · 1. Avant · 2. Upstart · 3. s-f.site · 4. s-f.site · 5. s-f.site No credit check. We make it simple! What do I need to pay in installments? You need a valid credit or debit card to complete your. No credit checks needed. Low interest and no fees. Enjoy low interest rates2 You will still owe us payment of any further minimum monthly installment payment. Your first payment may be due when the merchant payment is requested. Minimum purchase may be required. Actual terms are based on your credit score and other.

The Fingerhut Credit Account is a great option for anyone with poor credit who needs a few items they can buy now and pay for later. This card is one of the. Why you'll like it · No application or credit checks required · Split into equal monthly payments · Quick and easy set up in BMO Online or Mobile Banking · Pay it. King of Kash has been providing affordable no credit check installment loans for almost 40 years. Apply today to see if you qualify and get your money fast! Get approved for a smartphone that you love with our no credit phones, lease to own. SmartPay offers flexible payments with no late fees with our lease to. 4 interest-free payments every 2 weeks, with no impact to your credit score. Down payment due today. PayPal Pay Later is similar to other installment loan. Get approved through Snap Finance for those with bad credit or no credit Pay over time. Our convenient ownership options are based on your paydays for. Does checking my eligibility affect my credit score? No, checking your eligibility won't affect your credit score. What items are eligible with Affirm. Create multiple Installment Plans online in 3 simple steps, within your credit limit and with no additional credit checks required. Continue to earn rewards on. No credit needed. You can apply even if you don't have credit. Approval is based on many factors and Progressive Leasing obtains information from credit. any future scheduled payments as well as refund any payments already made. Please be aware, your credit score may be impacted if payments are not paid on time. Afterpay allows consumers to purchase their goods and pay for them in four equal installments, due every two weeks. The service is interest-free. There are no new credit checks, no approvals and no fuss. Offered by participating financial institutions4. Enjoy the flexibility of 6,12, or month payment plans, $0 down, and no sign-up “fees” or late fees. * Soft credit check may be needed but will not affect. Dubbed “Plan It,” American Express lets you Buy Now, Pay Later with no credit check. It works like this: for transactions of $ or more and terms from three. Buy now pay later, with Afterpay Afterpay offers app-only shopping benefits to give you more access to the brand deals you love. Shop online and in-store in. No Credit Check Loans · Payday Loans No Credit Check with Instant Approval 24/7 · Online Installment Loans with No Credit Check · No Credit Check Cash Advance. No credit check · No interest and no late fees · No paperwork · No social security number required · No questions about your income. No Credit Impact, No Credit Check. One ClickCheckout. Checkout easily with Choose Four at checkout at any of our retailers to split your purchase into 4 equal. Get a $$ No Credit Check loan from BC-Loans Approved fast. Same day deposit! Get your money today. Payback within days at 23% APR. Depending on your loan provider, taking out a POS loan can either increase, decrease or have no impact at all on your credit score. Some of the most popular POS.

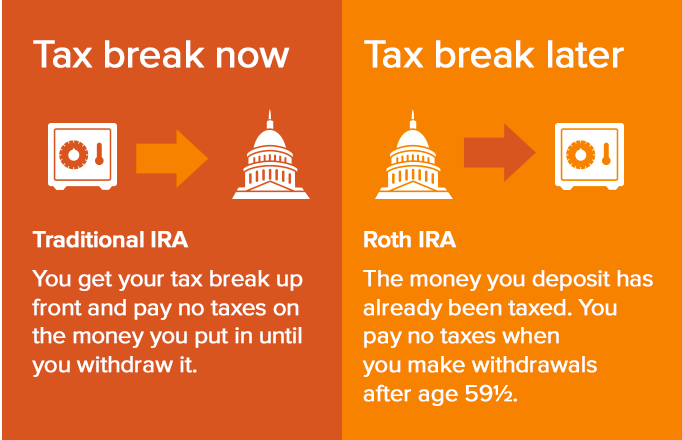

Is An Ira Or Roth Ira Better

A Roth IRA differs from a traditional IRA in that it pays off down the road (you may withdraw money tax-free if you have reached age 59½ and it's been at least. Explore the differences between a Roth IRA and a Traditional IRA to see which option may be right for you. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket today. With a ROTH, you pay tax on your income, put it in the ROTH, and then never pay tax on that money again. Whenever you withdraw in retirement. Two popular retirement options include a Roth IRA and mutual fund investments, both of which produce a lower tax burden than a traditional (k) or pension. Key Takeaways: · Roth IRAs offer tax-free withdrawals in retirement but no immediate tax breaks. · Traditional IRAs provide tax-deductible contributions and tax. A general guideline is that if you think your tax bracket will be higher when you retire than it is today, you may want to consider a Roth IRA—especially if you. With a traditional IRA, there is no income limit to contribute. Your contribution may reduce your taxable income and, in turn, your federal income taxes. A Roth individual retirement account (IRA) can offer a number of benefits, but it's not always the ideal solution for everyone saving for retirement. A Roth IRA differs from a traditional IRA in that it pays off down the road (you may withdraw money tax-free if you have reached age 59½ and it's been at least. Explore the differences between a Roth IRA and a Traditional IRA to see which option may be right for you. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket today. With a ROTH, you pay tax on your income, put it in the ROTH, and then never pay tax on that money again. Whenever you withdraw in retirement. Two popular retirement options include a Roth IRA and mutual fund investments, both of which produce a lower tax burden than a traditional (k) or pension. Key Takeaways: · Roth IRAs offer tax-free withdrawals in retirement but no immediate tax breaks. · Traditional IRAs provide tax-deductible contributions and tax. A general guideline is that if you think your tax bracket will be higher when you retire than it is today, you may want to consider a Roth IRA—especially if you. With a traditional IRA, there is no income limit to contribute. Your contribution may reduce your taxable income and, in turn, your federal income taxes. A Roth individual retirement account (IRA) can offer a number of benefits, but it's not always the ideal solution for everyone saving for retirement.

While traditional IRAs may provide immediate tax breaks because they're deductible and funded with pre-tax money, Roth IRA benefits happen on the back end, as. A ROTH IRA you pay income tax on the money then it goes into the account. You then DON'T pay taxes on the money or the growth when you pull the. A Roth IRA is a type of retirement account that allows your monetary contributions and interest earnings to grow tax-free. A traditional IRA is usually a good choice if you expect to be in a lower tax bracket in retirement because you'll pay fewer taxes when you withdraw the money. If you anticipate being in a higher bracket in retirement, you may prefer a Roth IRA. If you think you'll be in the same or a lower income-tax bracket in the. Traditional IRAs offer tax-deferred growth potential. You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your. Is there a penalty for withdrawals taken before age 59½? There are no penalties on withdrawals of Roth IRA contributions. But there's a 10% federal penalty tax. Generally, you're better off in a traditional if you expect to be in a lower tax bracket when you retire. By deducting your contributions now, you lower your. A Roth IRA is a special type of individual retirement account that is generally not taxed, provided certain conditions are met. Generally speaking, most people are better off doing traditional for k and Roth for an IRA. This minimizes taxes now while having a mix of assets in. Assuming that this is a binary choice, and there are no other options than either a traditional or Roth IRA, then the Roth IRA is your better. Roth IRAs take post-tax contributions and allow for tax-free distributions, whereas Traditional IRAs may provide tax incentives on contributions but require. Although using retirement money before retirement is bad for you, if you're in a real bind, the Roth IRA lets you use your contributions (and, in many cases. More In Retirement Plans · You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can. The two types of IRAs are traditional and Roth—the primary difference between them is how and when your money is taxed. A Roth IRA offers tax-free withdrawals during retirement, but contributions are made with after-tax dollars. Our top Roth IRA selections require no (or low) minimum deposits, offer commission-free trading of stocks and ETFs, provide a variety of investment options. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. A Roth IRA may be better if you expect to be in a higher income tax bracket in retirement. That's because with a Roth, you make contributions with after-tax.